Overview

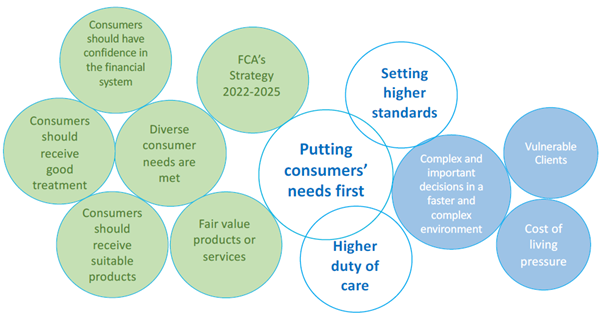

In July 2022, the Financial Conduct Authority (FCA) published the final rules for Consumer Duty – PS22/9: A new Consumer Duty, with the Finalised Guidance FG22/5.

The Consumer Duty (‘the Duty’) sets the standard of care that firms should give to customers.

There are three layers – the Consumer Principle, cross-cutting rules and four outcomes.

Firstly, the ‘Principle’ itself, which will form Principle 12 in the FCA’s sourcebook:

A firm must act to deliver good outcomes for retail customers.

What does ‘good outcomes’ mean? To help, the FCA have published ‘cross-cutting’ rules (which broadly cut across/apply to the four outcomes). These cross-cutting rules are for a firm to:

✔ Act in good faith

✔ Avoid causing foreseeable harm

✔ Enable and support retail customers to pursue their financial objectives

Below are the four areas in which the FCA expects to see good outcomes:

✔ products and services

✔ price and value

✔ consumer understanding

✔ consumer support

Influencing Factors

Target Market

DP Pensions Ltd, as the “manufacturer” of our SIPP products, are required by 30 April 2023 to share appropriate information with “distributors,” such as financial advisers and third party investment providers, which is necessary for them to meet their own obligations under Consumer Duty. For more information on the documents listed below, please see our Literature and Financial Adviser sections:

-Product Specification – Full SIPP

-Product Specification – Single Investment SIPP

-Product Specification – 7IM SIPP

-Financial Adviser Terms of Business

-DP Pensions Ltd due diligence information

-SIPP Adviser Charge Agreement

Contact and Support

Our dedicated project team, governed by Compliance and the Board of Directors, is required to review and identify any gaps within the customer journey in consideration with our SIPP products and service offering. We are also happy to share information with our distributors.

If you would like further information on Consumer Duty, or find out ways in which DP Pensions Ltd can support existing (and new) financial advisers and third party investment providers that market/distribute our SIPP products, please get in touch with:

| Elaine Turtle | Director | 01580 762555 | elaine.turtle@dapco.co.uk |

| Sally North | Compliance Manager | 01580 762555 | sally.north@dapco.co.uk |