A year ago the FCA announced it was going to carry out a Thematic Review of Retirement Income advice and now the results are in. Mark Whybrew, Head of Compliance at DP Pensions, discusses the “somewhat positive” mood from the FCA in their findings and, importantly, how we can support advisers.

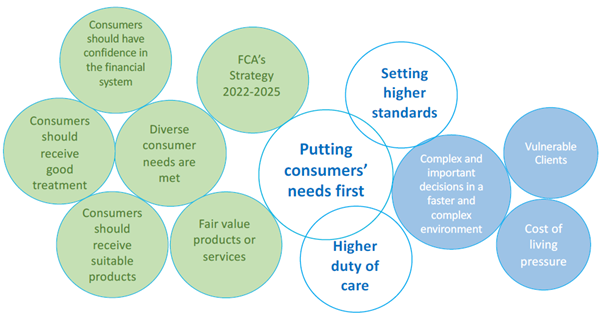

Astonishingly, when the announcement was made in 2023 that was nearly 8 years on from Pensions Freedom, although we did have the global pandemic during that period. This has, arguably, focussed the FCA’s attention even more – consumers’ needs have changed with the rising cost of living and the economic downturn meaning they require more flexible options.

The FCA published their results in March within TR 24/1 along with a Dear CEO Letter. Remember this piece of work is paramount with the Consumer Duty’s Principle 12 “a firm must act to deliver good outcomes for retail customers,” including those with characteristics of vulnerability. However, a moot point was that the file review assessments pre-dated the implementation of the Duty, so perhaps a difficult area to assess. Albeit the FCA did consider how firms were “planning” on complying and the results show that just over 50% of the advice firms subject to the desk-based advice review had not (at that time) defined their target market or shown that their products met their customers’ needs. Predictably, a concern that the FCA did voice.

Without going into all the statistics (which you can read in the above links or the industry’s press) I just want to remind you that, as per the norm with these types of reviews, the FCA’s concerns are underpinned by the lack of evidence, incomplete files or poor record keeping. Advisers should know what clients are being charged for ongoing advice and to make sure that it is being provided. I have explained further down how we can help in this area.

What key areas of improvement did the FCA identify?

- Income withdrawal strategy

- Risk Profiling and CFL

- Advice suitability

- Periodic Reviews

- Effective Oversight

Overall, the mood is fairly upbeat and poor practice is in the minority. It’s more a case of “fine tuning” advisers’ processes and perhaps extra work behind the desk, rather than actually in front of the client. However, additional time spent by paraplanners and compliance checkers all need to be taken into account when reviewing your advice charges.

I am sure this will not be first and last review in this area but in view of the relatively high level of suitable advice cases sampled you would like to think the FCA will focus their time on other areas (in the short term at least).

Support is available from DP Pensions

How can we help? As a SIPP provider we are always looking to assist financial advisers and their clients in the best ways possible. So in particular, focussing on the Thematic Review and the key areas of concern raised by the FCA, we have highlighted some examples of good practice where we can assist advisers –

✔ Our drawdown illustrations show clients when their income will be depleted. Advisers can request these or produce them on our website here at SIPP Illustrations

✔ Any client in drawdown will receive a bespoke letter and illustration from us once a year to show the impact of the level of pension that they are taking on their pension fund over time. The aim is to highlight how long their funds will last and to assist clients (and their advisers) to review the level of pension being taken.

✔ We want to make the client aware that the income meets their needs, not just now but in the future, as we recognise that this can constantly change throughout retirement. If it does not meet their income need, then it’s a prompt to review and change it.

✔ Clients are referred to an income tax calculator tool so that they can see how their withdrawal will be taxed and this is also confirmed to them separately. Advisers can also request this from us in advance as part of their recommendation and suitability process.

✔ A fund exhaustion check is also carried out by the client’s dedicated Account Manager so that the client (and their adviser) are made aware in advance if the pension pot or crystallised funds are close to being depleted. This avoids any awkward conversations advisers might have with clients over missing a monthly pension payment.

✔ Advisers are informed if a client contacts us directly to take pension benefits to make the adviser aware and give them an opportunity to provide advice.

✔ Technical Support is available to advisers for clients crystallising after April 2024 regarding Transitional Tax Free Amount Certificates. More information can be found here Member Benefits

✔ Clients will be receiving a Lifetime Allowance statement showing the % used before April 2024 which advisers will find useful in their advice process. We will send these to advisers in bulk but if you require this now then do let your Account Manager know.

✔ We will also be putting together some more case studies regarding the Lifetime Allowance and L-day changes so watch this space.

✔ Clients in vulnerable circumstances, or those that show vulnerable characteristics, are also flagged on our system so that we can adapt our processes to their needs to make sure they continue to be treated fairly. We will also liaise with the client’s financial adviser (if they are not already aware) and agree a strategy going forward.

✔ Our literature and client communications are regularly independently tested to ensure they are easy to understand.

✔ Flexible adviser charge fees are available as we recognise the different service and recommendations provided by advisers to meet their clients’ ever changing needs. Full client lists showing your adviser fees can be requested if you are in the process of compiling your client register.

✔ The client’s annual statement pack provides a drawdown illustration showing when the client’s fund will be depleted based on the current strategy. It also clearly discloses all the charges within the SIPP including any adviser fees.

Feedback from financial advisers on the above is that it’s extremely useful when carrying out pension reviews for their clients and provides valuable prompts throughout the year if the client’s pension income does need to be adjusted sooner rather than later.

Where can you find out about DP Pensions and our products?

Product details, target market and product specification documents are available on our website within our Literature section.

We also have a Due Diligence Information sheet which provides more information about our company that can be found under our Financial Adviser section.

Under this section you will see that we feature on a number of independent research tools that financial advisers can access to assist with their client risk profiling, recommendation and suitability of advice process:

| · Defaqto

· MoneyFacts · Capita Synaptic · SelectaPension · DDHub |

· Money Management

· Threesixty · Investment Sense · Centra · Engage |

If there are any other tools, or your network’s panel, that you would like us to feature on, then please let us know so that we can carry out the necessary due diligence checks for the onboarding process.

“Excellent” Customer Service rating

We always want to deliver the best possible service to our clients and use our feedback questionnaires to learn how we can improve our proposition. We are very proud to say that our customer service is rated as “excellent” (4.5 out of 5 stars) by our SIPP and SSAS clients as at 31/03/24.

Get in touch

If you would like to speak to us regarding taking benefits from an existing pension, or about a new case, then please contact your Account Manager or telephone 01580 762 555.